Analyzing Portfolio Downside Risk with R

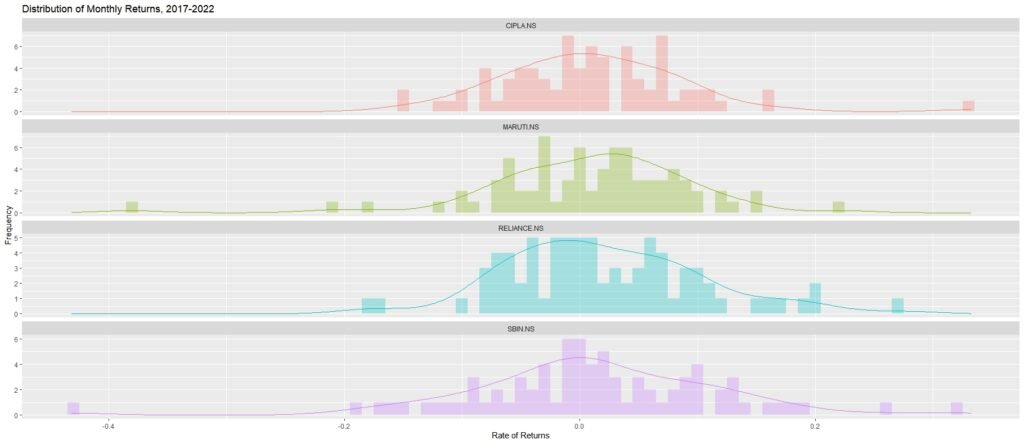

In the world of finance and investment, understanding the risk associated with your portfolio is paramount. One key aspect of risk analysis is examining downside risk, which refers to the potential for unfavorable returns or extreme losses. This is also termed as the Portfolio downside risk analysis. In this article, we will walk you through a comprehensive analysis of your portfolio’s downside risk using R, a powerful programming language for data analysis. We will explore essential statistical concepts such as kurtosis and skewness to gain insights into how your portfolio’s risk has evolved over time. Also, read Optimizing Investment using Portfolio Analysis in R What is Kurtosis? Kurtosis is a statistical measure that describes the distribution of returns in a portfolio. It measures the “tailedness” of the distribution, indicating whether the data has heavy tails or light tails compared to a normal distribution. Kurtosis helps investors assess the risk associated with extreme returns. The formula for kurtosis (K) is as follows: Where: Interpreting Kurtosis What is Skewness? Skewness measures the asymmetry of the distribution of returns in a portfolio. It helps investors understand whether the portfolio is more likely to experience positive or negative returns and the degree of asymmetry. The formula for skewness (S) is as follows: Where the variables are the same as in the kurtosis formula. Interpreting Skewness How to calculate Portfolio Downside Risk, Kurtosis and skewness using R Step 1: Load the Necessary Packages To begin, we load the essential R packages, including tidyverse and tidyquant, which provides a wide range of tools for data manipulation and financial analysis. Step 2: Define Your Portfolio and time frame Select the stocks you want to include in your portfolio and specify the start and end dates for your analysis. Step 3: Import Stock Prices Retrieve historical stock price data for the chosen stocks within the specified timeframe. Step 4: Calculate Monthly Returns Compute monthly returns for each asset in your portfolio using a logarithmic transformation and Assign weights to each asset in your portfolio, reflecting the allocation of investments. Step 5: Build the Portfolio and Assign Portfolio Weights Construct the portfolio using the assigned weights, and ensure that returns are rebalanced on a monthly basis to simulate real-world scenarios. Step 6: Compute Kurtosis and Rolling Kurtosis Calculate the kurtosis of the portfolio’s returns, a measure that quantifies the risk associated with extreme values. Compute and visualize rolling kurtosis to observe changes in downside risk over time. Step 7: Analyze Skewness and Return Distributions Calculate the skewness of individual assets and the portfolio, and visualize the distribution of returns for each asset. Now, let’s delve into the meaning of the terms and the insights we’ve gained: Kurtosis: Kurtosis measures the distribution of returns. A higher kurtosis indicates a riskier distribution with the potential for extreme returns, both positive and negative. If the portfolio kurtosis is greater than 3, it suggests a higher risk of extreme returns. A positive portfolio skewness indicates a potential for positive outliers, while a negative skewness suggests a higher likelihood of negative outliers. Rolling Kurtosis: This plot shows how the downside risk of the portfolio has changed over time. Peaks indicate periods of increased risk. Skewness: Skewness assesses the symmetry of return distributions. Negative skewness suggests more downside risk, while positive skewness indicates more upside potential. We observed that the portfolio’s downside risk improved slightly over the past year. During the pandemic, the portfolio experienced a surge in kurtosis, indicating high risk. However, recent data shows a negatively skewed distribution with lower kurtosis, signaling reduced risk. While historical data showed unattractive prospects, the portfolio now offers more consistent returns. For more such Projects in R, Follow us at Github/quantifiedtrader What does higher portfolio kurtosis mean? When the portfolio kurtosis is higher, it means that the distribution of returns in the portfolio has heavier tails compared to a normal distribution. In other words, the portfolio has a higher probability of experiencing extreme returns, both positive and negative. Here’s what a higher portfolio kurtosis implies: A higher portfolio kurtosis suggests that the portfolio’s returns are more volatile and that investors should be cautious about the potential for extreme outcomes, both positive and negative. It often indicates a higher level of risk associated with the investment. what does higher portfolio skewness mean? A higher portfolio skewness means that the distribution of returns in the portfolio is skewed towards one side of the mean (average). Specifically: Here’s what a higher portfolio skewness means: A higher portfolio skewness provides insights into the distribution of returns and how they are skewed relative to the mean. Positive skewness suggests more frequent small positive returns, while negative skewness suggests more frequent small negative returns. Understanding skewness is valuable for investors in managing their portfolios and assessing potential risks and rewards. Conclusion Understanding and monitoring downside risk is essential for making informed investment decisions. Through R and statistical measures like kurtosis and skewness, you can gain valuable insights into your portfolio’s risk profile and make adjustments accordingly.

Analyzing Portfolio Downside Risk with R Read More »