Optimizing Investment using Portfolio Analysis in R

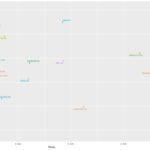

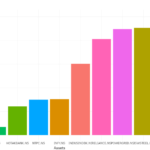

Investment decisions often involve constructing portfolios with diverse assets, each contributing a specific weight to the overall allocation. To simulate and optimize such portfolios, analysts frequently require a set of weighted random values. In this article, we will guide you through the process of generating weighted random values in R for portfolio analysis. We will use a list of 30 prominent stocks from the Nifty 50 index as our example dataset. Also, read Portfolio Optimization using Markowitz’s Mean Variance Method in R Why Generate Weighted Random Values for Portfolio Analysis? Portfolio analysis is a critical aspect of investment management. It involves constructing a diversified portfolio of assets to achieve specific financial goals while managing risk. Generating weighted random values serves several purposes: Step-by-Step Guide to Generating Weighted Random Values in R: Step 1: Data Retrieval and Preparation To start, we collect historical price data for stocks from the Nifty 50 index using the tidyquant package in R. This dataset will serve as the basis for our portfolio analysis. Step 2: Generating Random Weights Next, we need to generate random weights for our 28 stocks, which will represent their allocations in the portfolio. We do this using the runif function in R, which generates random numbers between 0 and 1. Step 3: Creating the Weighted Portfolio We then use the tq_portfolio function to create our weighted portfolio. This function combines the returns of the assets based on the weights we’ve generated, effectively simulating a portfolio. Step 4: Analyzing Portfolio Performance Now that we have our weighted portfolio, we can analyze its performance. We calculate key metrics such as standard deviation (risk) and mean return. Step 5: Visualization To gain insights from our portfolio, we visualize the relationship between risk (standard deviation) and expected returns. For more such Projects in R, Follow us at Github/quantifiedtrader Conclusion Generating weighted random values is a fundamental step in portfolio analysis and optimization. It enables investors and analysts to explore different portfolio scenarios and make informed investment decisions. By following this step-by-step guide in R, you can simulate and analyze portfolios, helping you to better understand the dynamics of your investments and ultimately make more informed choices in the world of finance. FAQs Q1: What is portfolio analysis in finance? Portfolio analysis is a process of evaluating and managing a collection of investments, known as a portfolio, to achieve specific financial goals while balancing risk. Q2: Why is portfolio analysis important? Portfolio analysis helps investors make informed decisions by assessing the performance, risk, and diversification of their investments. Q3: What are weighted random values in portfolio analysis? Weighted random values are randomly generated weights assigned to assets in a portfolio. They simulate different asset allocations for analysis. Q4: How can I generate weighted random values in R? You can generate weighted random values in R by using the runif function to create random weights and normalize them to sum up to 1. Q5: What is the standard deviation in portfolio analysis? Standard deviation measures the volatility or risk of a portfolio. A lower standard deviation indicates lower risk.

Optimizing Investment using Portfolio Analysis in R Read More »